There's more than one way to become an actuary and you can choose the route that best suits your situation now and your long term ambitions. Most people start with a maths-based degree at 2:1 or above and begin taking actuarial exams once they have secured a graduate role.

Others choose an actuarial apprenticeship and get started that way.

If you don’t have a background in maths but are interested in an actuarial career, we recommend you take one of our non-member exams to gain an understanding of the level of maths required to become an actuary.

As a minimum, we recommend that you start with an A Level or equivalent in Maths. This not only helps you build the groundwork for future exams, but it is also often a requirement for many employers. Beyond maths, it’s important to look at subjects you are most likely to enjoy and be successful at. This could be supporting subjects such as economics or physics. However, don’t underestimate the value of other subjects such as languages – these can help demonstrate your communication skills! Find out more about the different subjects you can choose in our blog 'What subjects you should study in school'.

With so many university courses to choose from, it can be hard to know where to start. Firstly, we recommend a course that is maths-based. You can choose from a number of maths-based subjects such as economics, physics, pure maths or statistics. We recommend choosing a course that includes a significant amount of maths modules.

Find out more about the different maths-based degrees you could choose in our blog, 'What degrees can help'.

If you would like to study a course that is specific to the actuarial profession, there are a number of actuarial science degrees that are accredited by the IFoA, which will help you prepare for a career as an actuary. We accredit university courses around the globe which can provide you with exemptions to some of our exams. This means you’ll have fewer exams to complete after you graduate, giving you a head start with your exams.

Visit our university exemption page to find out more about our accredited degree programmes.

Whatever programme you pick, most employers will look for a 2:1 as a minimum so make sure that you study something that you will enjoy and excel at.

Watch our video below where professionals discuss the key attributes that they feel are helpful when deciding on this exciting and diverse profession.

There are a small number of actuarial apprenticeships available for those who don’t wish to go to university after leaving school. Our Level 4 actuarial technician apprenticeship is your first step towards a career in finance as an actuarial analyst. Upon completion, you may also wish to consider applying for a Level 7 apprenticeship to begin your path to qualifying as an Actuary.

More information about apprenticeships is available on our actuarial apprenticeships page.

Whether you choose to go to university or complete an apprenticeship, you will need to secure your first actuarial role. This role will help you to put the skills you gain thorough our exams into practice and will provide you with the necessary work experience you need to qualify as an Associate or Fellow of the IFoA. Many employers will provide you with study support and fund your exams. The entry requirements for trainees will vary depending on the employer and the specific role.

To find out more about the types of roles available for trainees download our Employer Directory.

If you are an overseas student, we have tailored resources available to guide you as you take your first steps towards a career in actuarial science.

Stay up-to-date with the latest news about trainee and graduate roles and employer events by completing our careers contact form.

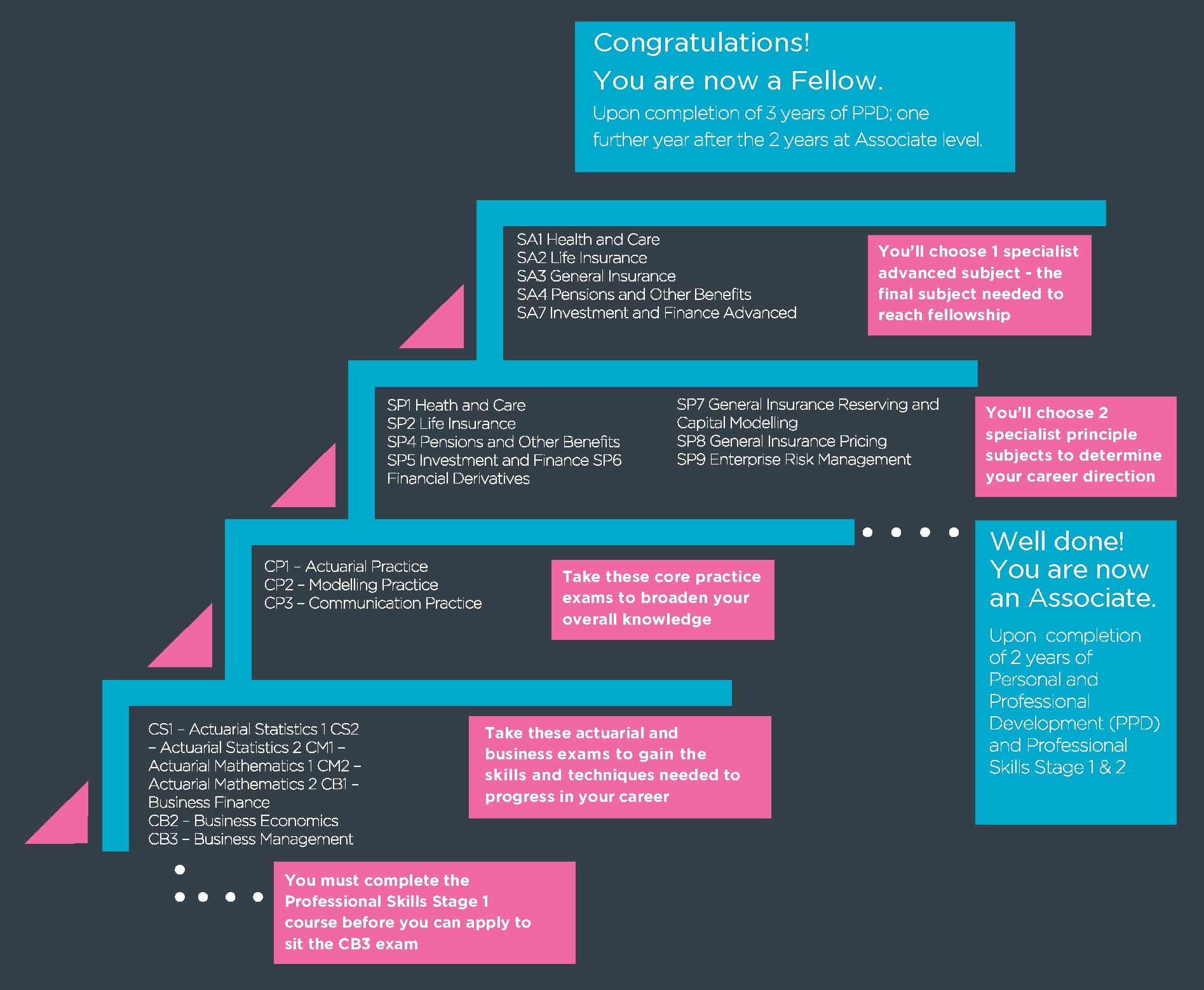

Although our exams may seem complex, there is plenty of support and guidance available to you. Depending on the modules you study, the grades you achieve and whether your degree programme is IFoA accredited, you can apply for exemptions from IFoA exams. This will help reduce the number of exams you will need to take to become an actuary. If you don’t have any exemptions, you will start with our first exam.

There are 2 opportunities to sit exams each year, in April and September. To find out more about the exam dates and the deadlines for application visit the exams dates web page.

Watch our video for tips on managing the challenge of exams.

Before you can begin your exams and gain exemptions, you will need to become a student member of the IFoA. The only exception is if you have chosen to take one of our first exams as a non-member. As a student member, you will be able to access to a range of resources to support your studies and become part of a global network of talented individuals.

Find out how you can join the IFoA as a student member.

Download our Careers Guide for for more information about becoming an actuary, the routes you can take and advice to help you get started.

If you would like to find out more about how you can secure work experience, placements or graduate opportunities and hear from those within the actuarial profession, download our Employer Directory.

If you’re based outside of the UK, we have tailored resources and local networks to guide you as you take your first steps towards a career in actuarial science.

Stay up-to-date with the latest news, activities and events to support your journey to become an Actuary.