11 July 2023

In light of the coronavirus pandemic, the Continuous Mortality Investigation (CMI) is publishing frequent UK mortality analysis through its mortality monitor. Today’s updates cover week 26 of 2023 (to 30 June) and the second quarter of 2023, based on provisional deaths data published for England & Wales by the Office for National Statistics (ONS) on 11 July 2023, for Scotland by National Records of Scotland on 6 July 2023 and for Northern Ireland by Northern Ireland Statistics and Research Agency on 7 July 2023.

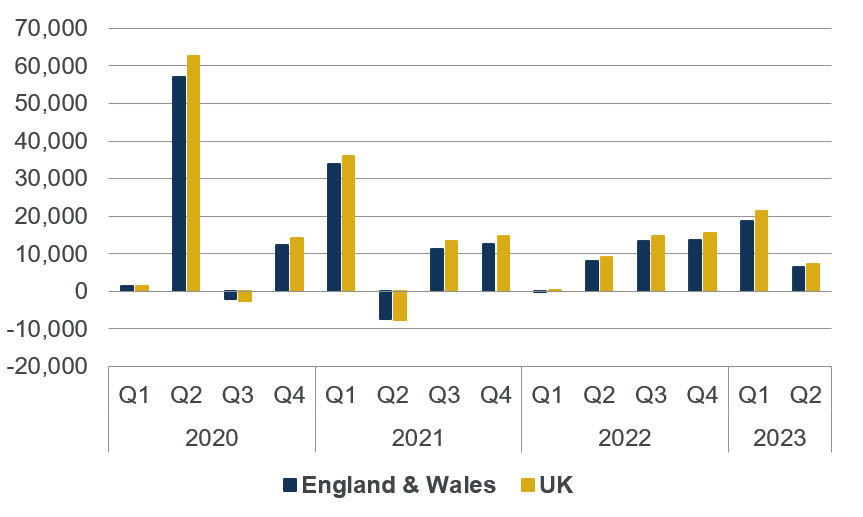

The mortality monitors have been updated to take account of the results of the 2021 census published to date by the ONS. The census changes our view of population estimates and leads us to increase our estimate of excess mortality.

The key points of the quarterly update are:

The key points of the week 26 update are:

Cobus Daneel, Chair of the CMI Mortality Projections Committee, said: “The second quarter of 2023 saw continuing excess mortality for the fifth quarter in a row, but at a lower level than the previous year.

“However, despite falling COVID deaths, mortality in 2023 is very likely to be higher than 2022.”

All mortality monitor weekly updates are publicly available on the mortality monitor page.

~ENDS~

Sonia Sequeira, Communications Lead, IFoA

Tel: 07525 592 198

Email: sonia.sequeira@actuaries.org.uk

Continuous Mortality Investigation Limited (‘the CMI’) is wholly owned by the Institute and Faculty of Actuaries but has an independent executive and management.

The CMI’s mission is to produce high-quality impartial analysis, standard tables and models of mortality and morbidity for long-term insurance products and pension scheme liabilities on behalf of subscribers and, in doing so, to further actuarial understanding.

The Institute and Faculty of Actuaries (IFoA) is a royal chartered, not-for-profit, professional body.

Research undertaken by the IFoA is not commercial. As a learned society, research helps us to fulfil our royal charter requirements to further actuarial science and serve the public interest.

Actuaries provide commercial, financial and prudential advice on the management of a business’s assets and liabilities, especially where long term management and planning are critical to the success of any business venture. They also advise individuals, and advise on social and public interest issues.

Members of the IFoA have a statutory role in the supervision of pension funds and life insurance companies. They also have a statutory role to provide actuarial opinions for managing agents at Lloyd’s of London.

Members are governed by the Institute and Faculty of Actuaries. A rigorous examination system is supported by a programme of continuing professional development and a professional code of conduct supports high standards reflecting the significant role of actuaries in society.

The IFoA is available to provide independent expert comment to the media on a range of actuarial-related issues, including COVID-19 and its long term consequences, mortality, pensions, life and general insurance, health and care, finance and investment, climate change and sustainability, systems thinking, uncertainty and judgement, and risk management.